Business

How to Use Videos to Convert Visitors Into Customers

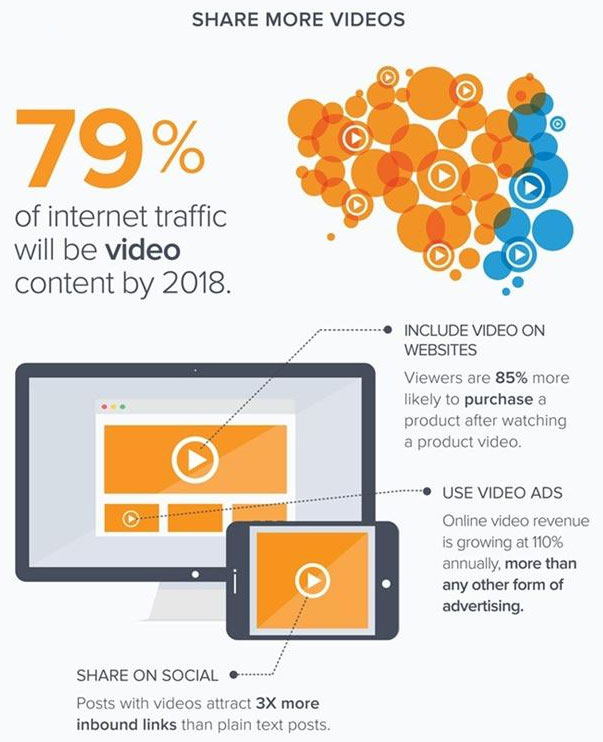

Usage of good videos in an appropriate way will not only boost brand recognition and traffic but also improve the conversions.

Indeed, video is one of the most growing and effective marketing strategies that is helping businesses to grow their ROI if done right. Companies try creating the best explainer videos to attract loyal customers and convert them into leads.

Usage of good videos in an appropriate way will not only boost brand recognition and traffic but also improve the conversions. Most businesses think that videos are commonly used to attract social media users. It’s not true. There are various ways to use videos that will up your conversion rates without breaking the banks.

Now, without any ado, let’s dive into the ways to use videos in your marketing strategy to achieve your targets.

Different ways to use videos in marketing strategy

Let’s roll…

Table of Contents

1. Boost your sales with a video advertisement

Advertising your products/services through videos is a tried and true method that helps businesses to promote their and increase revenue.

By running video campaigns on social platforms like Facebook, Instagram, Twitter, etc., you can easily engage a large no. of people at a single time.

According to the report, people spend more than six and a half hours online every day. It shows that an online platform is one of the best ways to grab the customer’s attention and convert them into leads.

So, irrespective of usage of Google Ads or social media platforms, if you are not creating video ads, then you’re missing out something huge.

Read more:- Here Are 8 Video Marketing Trends to Watch Out.

2. Use lead capture form in the starting.

Well! Creating and sharing regular video content is an unsure way to convert leads. As we all are putting lots of effort into creating appealing and educational videos, each video must help us capture leads. Thus to make your video highly productive, you can use lead capture form after 20-50 seconds of your video.

According to the research conducted by Wistia, videos that include forms in the first 10-20% of it have the highest conversion rate, which is around 38-43%.

So, if you want to see your list growing faster, don’t forget to use lead forms in your videos before sharing it on other platforms.

Source: webbiquity

3. Add videos in emails or newsletter.

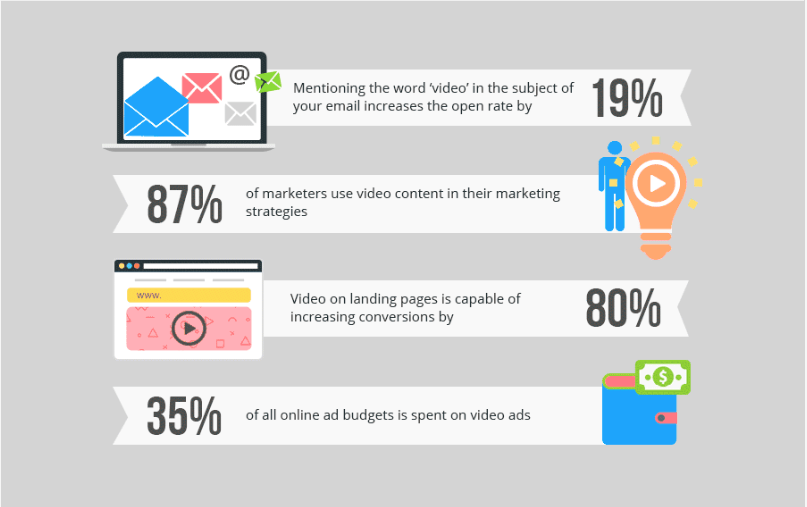

When it comes to marketing and sharing information with prospects, emails are a traditional way to do that. According to the statistics, there are 9 out of 10 marketers who use emails to share the content organically. If I am not wrong, you might be using it to increase traffic and conversions. So, do you want to improve your results by upgrading the same approach? If yes, start using video email marketing.

Say, if you add videos in your emails, you will experience a 96% enhancement in the click-through rate. People love visuals more than text images. Now that you understand the usage of videos in emails start personalizing it.

4. Improve your blog quality with videos

The blogs are another important content from that is created by organizations to educate people and grab their attention. As people prefer visuals more than long boring text, so you can increase the chances of people to stay on your content.

Say if you add fascinating and educational videos in your blogs, then you will not only add value to your content but also you candidly engage more people.

It’s not surprising to see that videos generate 12 times more shares in comparison to other forms of content. Always remember, the more people view your content, the higher the chances to convert them to leads.

So, whenever you create videos for your blogs, make sure it is relevant to your content and help people understand the concert better.

5. Include videos on the homepage

It can not be wrong to say that a website is the base of your online business. If your website is both responsive and engaging, it becomes easy to catch the visitor’s eye and inspire them to make a purchase. To make your website highly productive, you can incorporate videos on the homepage of your website.

Visitors who land on your home page and view the video will get to know about who you are, what you offer, & how the services/products can help them achieve their goals. That’s why almost 58% of the business have impressive videos on their homepage.

Remember, the more people know your brand, the higher the chances they will land on the decision to make a purchase. Thus, try crafting the right videos for your websites to generate more sales.

Source: motion cue

6. Play videos on events/ onboardings/training sessions

Broadcasting, live streaming, organizing events are incredible ways to generate traffic, engage people, and increase conversions. Most successful organizations use this approach to appear in the top searches of google.

As everyone is using this approach, what one should do exceptionally to stand out from the crowd. Well! Videos are the easiest ways to do it. If we talk about hosting events, most of the organizations play presentations to explain the concept, which sometimes becomes quite dull. And if we talk about the onboarding process, managers deliver speeches to present the concert, which sometimes becomes both tedious and complicated.

To get rid of all the issues, you can create videos to share your thoughts and concert the visitors. It will help you share information in a detailed form and impress the viewers. So, make sure you utilize videos to the fullest and achieve your targets.

7. Send personalized videos to people.

Last but not least, send personalized videos to the prospects to raise the conversion rate. If I am not wrong, then most of the salespeople struggle to influence the people by explaining the same concepts time and again to get leads. Isn’t it? That’s where video comes into play.

You can send personalized videos to the prospects over mail instead of sending boring texts. To make it more effective, you can add CTA at the end of the video to re-engage the leads and convert them into potential customers.

So, start sending personalized videos to convert visitors into loyal customers.

Prefer reading:- Stand Out From The Crowd With These Eight Video Promotion Ideas

Final Thoughts

There are thousands of companies that are adopting all these strategies to bombard their sales process. Now it’s your turn…..

Start creating compelling videos that not only educate the people but also inspire them to become promoters. To make sure your videos are the best, you can again hire the best explainer video production companies. They will provide you with excellent videos at an affordable cost.

Also, if you have any other suggestions, do share in the comment section below.

Business

Tax Filing Advice: Self-employment Tax (IRS Form 1040)

In this post, we’ll show you how to fill out Form 1040 and offer some tips on how to minimize your tax obligations. Tax Filing Advice – Self-employment Tax – IRS Form 1040.

Filing your taxes can be challenging, especially if you are a freelancer. As a freelancer, you are required to pay self-employment tax, maintain track of your revenues and expenses, and submit projected tax payments throughout the year. You can complete an IRS Form 1040 with a little help and a quarterly tax calculator, despite the fact that it could appear challenging. In this post, we’ll show you how to fill out Form 1040 and offer some tips on how to minimize your tax obligations.

Table of Contents

1. Assemble Your Papers

Before you start filling out your Form 1040, you must gather all the necessary information and paperwork. Your W-2s, 1099s for any freelance work you did, receipts for any anticipated tax deductions, and any other financial records you might have are included in this. You must also include your Social Security number and the Social Security numbers of any dependents you wish to claim.

2. Verify Your Filing’s Status

Your file status affects your tax rate and the size of your standard deduction. Determine which filing status is appropriate for you based on your marital status, the number of dependents you have, and other factors.

3. Ascertain your income

Your total income for the tax year is what is referred to as your gross income. This includes all forms of income, including wages, salaries, tips, and revenue from side jobs. Add up your income for the tax year and gather all of your supporting papers. List all of your sources of income from contract work.

4. Remove Your Modifications

By deducting adjustments from your gross income, you can reduce your taxable income. They also pay your health insurance premiums, student loan interest, and IRA contributions if you work for yourself.

5. Choose Your Tax Savings

By taking some expenses out of your taxable income, you can reduce it. The two distinct types of tax deductions are standard and itemized. The standard deduction is an agreed-upon sum of money that is available to all tax filers. As itemized deductions, you are allowed to deduct some costs like state and local taxes, charity giving, and mortgage interest. It is better to select the tax deduction that would result in the greatest financial savings.

6. In Step Six, determine your taxable income.

After subtracting either your standard deduction or your itemized deduction from your AGI, your taxable income will be determined. According to federal law, this amount is your taxable income.

7. Choose Your Tax Credits

They are made up of education, earned income, and child tax credits. To reduce your tax obligation, find out which tax credits you are eligible for.

8. Find Out How Much Tax You Owe

Your overall tax liabilities, less any payments or credits, are referred to as your tax burden.

9. Verify Your Upcoming Tax Payments

If you are self-employed, you must make estimated tax payments throughout the year. Check your expected tax payments throughout the year to ensure you made the required amount to avoid underpayment penalties.

10. Finishing Schedule C

Schedule C, the relevant form, is used to report your self-employment earnings and expenses. To calculate your self-employment tax, which is based on your net self-employment income, use Schedule C. In addition to this, you will also owe regular income tax.

11. Add Up Your Credits and Payments

Add all of your year-end payments, such as estimated tax payments and any taxes you have withheld from your pay. If you qualify, take a deduction for any tax credits. Here, your overall payments and credits will be displayed.

12. Figure out whether you owe a refund or are due one.

You should evaluate your entire tax burden in relation to your total payments and credits. If your tax due is greater than the sum of your payments and credits, you will be obliged to pay extra tax.

13. Upload Your Return

When you’ve finished filling out Form 1040 and any necessary attachments, sign and date your return, and then send it to the relevant IRS address. Make sure to keep a copy of your return and any supporting documents for your keeping.

14. Tips on How to Cut Your Taxes as Much as Possible

Now that you know how, let’s speak about how to complete Form 1040 so that you may maximize your tax savings as a freelancer.

Using tax deductions is a smart move.

As a freelancer, you might be eligible to write off a range of expenses from your taxes, such as business travel, office supplies, and office equipment. Keep note of all your expenses throughout the year in order to maximize any relevant deductions.

Submit projected tax payments

As was previously stated, self-employed individuals are obligated to make projected tax payments throughout the year. This allows you to keep track of your tax obligations and prevent underpayment fines.

You May Want To Add

The ability to deduct more business expenses and a lower tax rate on self-employment income are just two of the additional tax benefits that incorporating your freelancing business may offer. Speak with a tax professional if you’re unsure if incorporation is the right option for you.

Employ tax-favored retirement accounts.

You may be able to reduce your taxable income and increase your tax savings by contributing to tax-advantaged retirement plans like an IRA or Solo 401(k). Use these accounts if you meet the requirements.

Conclusion

Although filling out a Form 1040 can be intimidating, with a little planning and assistance, it is actually rather easy. Even though you may face certain challenges as a freelancer when attempting to maximize your tax savings, there are a number of strategies you may employ to help minimize your tax burden. By taking advantage of tax deductions, paying expected taxes, considering incorporation, and using tax-advantaged retirement plans, you may keep more of your hard-earned money in your pocket.

-

Instagram2 years ago

Instagram2 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

-

Instagram2 years ago

Instagram2 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

-

Business4 years ago

Business4 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

-

Instagram3 years ago

Instagram3 years agoInstagram Followers And Likes – Online Social Media Platform